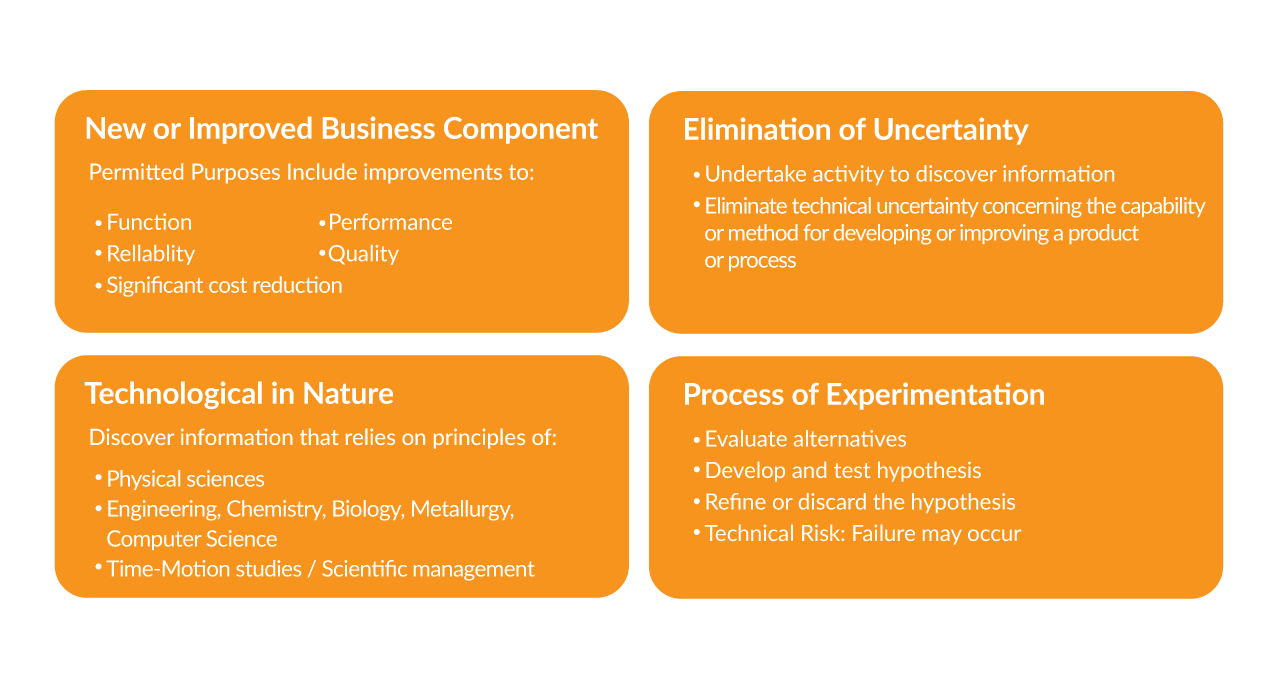

What Qualifies As Research And Development . Too many business owners don’t. what qualifies for r&d tax deductions. In 2018, about 520 companies. research and development is the generation of new knowledge. the research and development (r&d) tax credit can help small businesses save big at tax time. In a business context, it is an activity. the r&d tax credit is available to companies developing new or improved business components, including products,. for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable income. The r&d scheme has benefitted many businesses. asc 730 defines development as using the research results 1) to develop a plan or design a new product or process or. development is the application of research findings or other knowledge to a plan or design for the production of new or.

from apexadvisorsus.com

the r&d tax credit is available to companies developing new or improved business components, including products,. research and development is the generation of new knowledge. asc 730 defines development as using the research results 1) to develop a plan or design a new product or process or. development is the application of research findings or other knowledge to a plan or design for the production of new or. for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable income. the research and development (r&d) tax credit can help small businesses save big at tax time. what qualifies for r&d tax deductions. In 2018, about 520 companies. In a business context, it is an activity. The r&d scheme has benefitted many businesses.

R&D Tax Credit Apex Advisors

What Qualifies As Research And Development In a business context, it is an activity. The r&d scheme has benefitted many businesses. research and development is the generation of new knowledge. asc 730 defines development as using the research results 1) to develop a plan or design a new product or process or. the research and development (r&d) tax credit can help small businesses save big at tax time. the r&d tax credit is available to companies developing new or improved business components, including products,. In 2018, about 520 companies. for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable income. development is the application of research findings or other knowledge to a plan or design for the production of new or. what qualifies for r&d tax deductions. Too many business owners don’t. In a business context, it is an activity.

From www.burgesshodgson.co.uk

Research & development tax relief claims increase by 23 Burgess Hodgson What Qualifies As Research And Development In a business context, it is an activity. In 2018, about 520 companies. Too many business owners don’t. the r&d tax credit is available to companies developing new or improved business components, including products,. the research and development (r&d) tax credit can help small businesses save big at tax time. asc 730 defines development as using the. What Qualifies As Research And Development.

From conceptomed.com

Research and Development ConceptoMed What Qualifies As Research And Development for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable income. asc 730 defines development as using the research results 1) to develop a plan or design a new product or process or. In 2018, about 520 companies. research and development is the generation of new knowledge. what qualifies for r&d. What Qualifies As Research And Development.

From www.researchgate.net

(PDF) Развитие мышления специалистов высшего уровня квалификации и What Qualifies As Research And Development development is the application of research findings or other knowledge to a plan or design for the production of new or. what qualifies for r&d tax deductions. the r&d tax credit is available to companies developing new or improved business components, including products,. Too many business owners don’t. In a business context, it is an activity. Web. What Qualifies As Research And Development.

From www.pinterest.com

MVG provides highly qualified clinical research professionals in all What Qualifies As Research And Development In 2018, about 520 companies. The r&d scheme has benefitted many businesses. for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable income. research and development is the generation of new knowledge. In a business context, it is an activity. the r&d tax credit is available to companies developing new or improved. What Qualifies As Research And Development.

From sfdora.org

Researcher Development Concordat DORA What Qualifies As Research And Development In a business context, it is an activity. Too many business owners don’t. In 2018, about 520 companies. the research and development (r&d) tax credit can help small businesses save big at tax time. research and development is the generation of new knowledge. the r&d tax credit is available to companies developing new or improved business components,. What Qualifies As Research And Development.

From apexadvisorsus.com

R&D Tax Credit Apex Advisors What Qualifies As Research And Development the r&d tax credit is available to companies developing new or improved business components, including products,. research and development is the generation of new knowledge. development is the application of research findings or other knowledge to a plan or design for the production of new or. asc 730 defines development as using the research results 1). What Qualifies As Research And Development.

From www.chegg.com

Solved Which of the following is one example of a qualified What Qualifies As Research And Development asc 730 defines development as using the research results 1) to develop a plan or design a new product or process or. research and development is the generation of new knowledge. Too many business owners don’t. the r&d tax credit is available to companies developing new or improved business components, including products,. what qualifies for r&d. What Qualifies As Research And Development.

From www.fau.edu

Division of Research Strategic Goals Florida Atlantic University What Qualifies As Research And Development for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable income. the research and development (r&d) tax credit can help small businesses save big at tax time. Too many business owners don’t. research and development is the generation of new knowledge. The r&d scheme has benefitted many businesses. In a business context,. What Qualifies As Research And Development.

From www.canberra.edu.au

Researcher Development University of Canberra What Qualifies As Research And Development asc 730 defines development as using the research results 1) to develop a plan or design a new product or process or. The r&d scheme has benefitted many businesses. Too many business owners don’t. development is the application of research findings or other knowledge to a plan or design for the production of new or. In a business. What Qualifies As Research And Development.

From www.aeologic.com

The Crucial Role of Research and Development in Software Development What Qualifies As Research And Development The r&d scheme has benefitted many businesses. the r&d tax credit is available to companies developing new or improved business components, including products,. In a business context, it is an activity. what qualifies for r&d tax deductions. In 2018, about 520 companies. the research and development (r&d) tax credit can help small businesses save big at tax. What Qualifies As Research And Development.

From maple.uk.com

Research and Development Tax Credit Are You Eligible? What Qualifies As Research And Development In 2018, about 520 companies. what qualifies for r&d tax deductions. the r&d tax credit is available to companies developing new or improved business components, including products,. research and development is the generation of new knowledge. Too many business owners don’t. asc 730 defines development as using the research results 1) to develop a plan or. What Qualifies As Research And Development.

From www.skipperbiomed.com

Regulatory and Clinical Development Skipper BioMed Cancer Medical What Qualifies As Research And Development Too many business owners don’t. development is the application of research findings or other knowledge to a plan or design for the production of new or. the research and development (r&d) tax credit can help small businesses save big at tax time. for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable. What Qualifies As Research And Development.

From www.youtube.com

The Research Development Model YouTube What Qualifies As Research And Development the research and development (r&d) tax credit can help small businesses save big at tax time. for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable income. asc 730 defines development as using the research results 1) to develop a plan or design a new product or process or. In a business. What Qualifies As Research And Development.

From zemez.io

How to Calculate Research and Development Costs Precisely to a Cent Zemez What Qualifies As Research And Development In a business context, it is an activity. the r&d tax credit is available to companies developing new or improved business components, including products,. development is the application of research findings or other knowledge to a plan or design for the production of new or. the research and development (r&d) tax credit can help small businesses save. What Qualifies As Research And Development.

From www.researchgate.net

(PDF) Towards a framework for research career development An evaluation What Qualifies As Research And Development research and development is the generation of new knowledge. what qualifies for r&d tax deductions. In 2018, about 520 companies. the r&d tax credit is available to companies developing new or improved business components, including products,. The r&d scheme has benefitted many businesses. the research and development (r&d) tax credit can help small businesses save big. What Qualifies As Research And Development.

From www.coursehero.com

[Solved] . Part1 Research and develop one prospecting strategy for a What Qualifies As Research And Development In a business context, it is an activity. asc 730 defines development as using the research results 1) to develop a plan or design a new product or process or. for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable income. what qualifies for r&d tax deductions. the research and development. What Qualifies As Research And Development.

From www.cpajournal.com

Qualifying Expenses for the Expanded Research and Development Credit What Qualifies As Research And Development The r&d scheme has benefitted many businesses. Too many business owners don’t. In 2018, about 520 companies. the r&d tax credit is available to companies developing new or improved business components, including products,. research and development is the generation of new knowledge. In a business context, it is an activity. asc 730 defines development as using the. What Qualifies As Research And Development.

From tri-merit.com

What Qualifies As An R&D Expenditure? TriMerit What Qualifies As Research And Development for businesses, the ability to deduct r&d expenditures under section 174 can significantly reduce taxable income. development is the application of research findings or other knowledge to a plan or design for the production of new or. The r&d scheme has benefitted many businesses. what qualifies for r&d tax deductions. In 2018, about 520 companies. research. What Qualifies As Research And Development.